FOR YOUR SMALL BUSINESS

Same Day Funding Finance $5,000 up to $5 million

Terms from 6 months to 10 years

EQUIPMENT FINANCING

what is equipment financing

Equipment financing is a way for businesses to obtain equipment through a loan or lease. It can be used to purchase almost any tangible asset for a business. Some examples of equipment that can be financed include: medical equipment, office furniture, production equipment, and technology.

WHAT DO YOU NEED TO QUALIFY?

No Minimum Time in Business

You can qualify for our top financing options, regardless of the age of your business. Companies with under two years time in business are capped at $50,000.

No Minimum Monthly Gross Sales

You can qualify for equipment financing with no minimum in monthly gross sales.

Credit Requirements Vary Based on Equipment

We have financing options for all credit profiles. The minimum FICO score required to apply is 580. All equipment financing transactions are based on the following: time in business, FICO, equipment type, annual revenue, industry, geographical location, and other compensating factors.

Getting a loan

is easy!

Apply Online

Our simple 15-second online application can get you matched with offers in minutes.

NO MINIMUM FICO

Bad credit? No problem! Most of our top financing options have no minimum FICO.

LARGER AMOUNTS

Get matched with the best financing options with the highest funding amounts.

SAME DAY FUNDING

Our Fintech speed can get you in and out of Underwriting in just a few hours, and same day!

WHY DEQ FINANCIAL

WHY DEQ FINANCIAL?

STELLAR REPUTATION

Backed by thousands of 5-Star reviews, facing our business financing experts will work with you to solve your business challenges.

TECHNOLOGY-FIRST APPROACH

DEQ Intelligence uses AI to streamline the funding process. Get an instant pre-approval and flexible loan options that fit your business needs.

MULTIPLE OPTIONS

Choose an offer that makes the most sense for you and your business. Compare offer terms and choose what works best.

ZERO SUPRISES

DEQ's offer calculator takes the guesswork out of business financing. It provides full transparency on terms. No suprises.

DEQ FINANCIAL Intelligence- Our winning combination of quick delivery and excellent customer care. Getting started is easy.

STEP 1. APPLY ONLINE

STEP 2. REVIEW OPTIONS

STEP 3. RECEIVE YOUR FUNDS

500+

Satisfied Customers

15+

Years of Experiance

20+

Cities Covered

5k

Staff Members

Great Bank! They found the loan that maximized my revenue and gave me the best return on the money I obtained. We all take money to make money, but they really made sure I could optimize my position and increase my borrowing power and line of credit to ensure my business stays on a rising scale. ⭐⭐⭐⭐⭐

David

STILL NOT SURE?

Frequently Asked Questions

&

GLOBAL RESOURCES

Question 1: WHAT ARE THE BENEFITS OF SMALL BUSINESS FUNDING?

Small business loans can help you reach many of your business goals. They can help you keep control of your profits and business, avoid problems with loans from family or friends, and protect you from putting your personal assets at risk.

Question 2: ARE THERE ANY REQUIRED DOCUMENTS TO GET A SMALL BUSINESS LOAN?

Yes, your Tax ID or SSN, business license, and recent tax filings, balance sheets, and bank statements will expedite lender approval.

Question 3: WHAT ARE AVERAGE SMALL BUSINESS LOAN RATES?

Loan rates will be dependent upon the type of loan for which you are applying. There is also some variation depending on the amount you need and the specific terms.The truth is that small business loan rates from alternative lenders can also be higher than traditional bank loans. However, there’s a tradeoff: while some business owners may not qualify for financing through a traditional lender, an alternative lender can fill that gap.

Question 4: ARE 3 MOST RECENT MONTHS BANK STATEMENTS REQUIRED?

For certain loans yes. Obviously if you are applying for a start-up loan, you will not have bank statements for your business, but if you are an LLC that operated as a Sole-Prop, 3 months of personal banks statements may be required.

The question of “How do small business loans work” is the natural question when deciding on growth possibilities or starting a small business.

Small business loans allow existing or startup companies to borrow money from various lenders. Various loan types exist to help entrepreneurs meet different goals. The way each loan works depends on the type of loan.

Maybe you’ve come up with that product that has the market beat. Or, maybe you need a piece of equipment that would tip your business’s growth over the top. Or, maybe outstanding invoices have you in need of funds for operating costs. Whatever it may be, it may be time for a loan.

What is a small business loan?

So, what is a small business loan? Simply put, a small business loan is any funding option specifically designed for a small business. Small business loans allow existing or startup companies to borrow money from various lenders. Various loan types exist to help entrepreneurs meet different goals. The way each loan works depends on the type of loan.

There are many business loans on the market and it can be beneficial to go over just a few of them.

Term Loan– A standard bank-type loan. You receive the funding and pay off the principle plus interest over time.

Equipment Financing– An excellent way for a growing business to get an edge. You receive the equipment upfront and pay it off over the life of the equipment.

Accounts Receivable Financing– If you have large amounts of outstanding invoices, you can borrow against them. The invoices act as collateral and AR Financing offers lower rates.

Merchant Cash Advance– A merchant cash advance is borrowed against future credit card sales. A borrower then pays back a percentage of daily CC sales to the lender. So, you never have to see the payments!

Business Line of Credit– A business line of credit works just like a non-physical credit card. The owner of a small business is extended a line of credit and is charged the interest only or what is spent.

Term Loans

Equipment Financing

Accounts Receivable Financing

Business Line of Credit

Installment Loans

Merchant Cash Advance

Startup Funding

Asset Based Loans

Residential Investment Loans

Franchising Financing

SBA Loans

Small Business Loans

Commercial Real Estate Financing

Cash Advance Calculator

Business Factoring

Become A Partner

The Unit

Schedule An Appointment

Business Credit Building

Careers

Home

Costs

Loan amount:

$20,000.00

Repayment period:

6 months

Total Payback:

$3,666,67 (Monthly)

If you're a small business owner in need of extra funds, you may be interested in a merchant cash advance.

You probably have a few questions, like:

how does a merchant cash advance work? And, can I qualify for a merchant cash advance with bad credit? Visit our blog to learn more and find out how a Merchant Cash Advance works

.A merchant cash advance may be the ideal solution to your small business cash flow needs, but it's not always the most appropriate option. Try out our calculator below to get an estimate of what your payment may be. To find out if this is your best option, be sure to speak with one of our Business Financing Advisors.

* These are estimated amounts based on initial criteria from our lending partners and are based on the accuracy and completeness of the data you have entered. This tool is for illustrative and general information purposes only and is not to be treated as an offer - please speak to your sales representative to verify actual final amounts.

FAQS

WHAT'S THE DIFFERENCE BETWEEN A MERCHANT CASH ADVANCE AND A LOAN?

A merchant cash advance isn’t technically a loan with set terms. It is an advance on future sales and is paid back by taking an agreed upon percentage on a daily or weekly basis. The benefits of a merchant cash advance are you can pay back the loan as quickly or as slowly as your business sales allow.

HOW DOES A MERCHANT CASH ADVANCE WORK?

A merchant cash advance lender will provide you a lump sum of money in exchange for a percentage of your future credit card sales. Instead of making a fixed payment over a period of time your loan is paid back usually daily or weekly by the lender collecting that set percentage of your credit card sales.

HOW EASY IS THE MCA APPROVAL PROCESS?

Merchant cash advances (MCAs) are generally considered to be an easy type of business financing to qualify for, with approval rates as high as 90%. MCAs are often available to businesses that may not qualify for other types of loans, such as small business loans, equipment loans, or business lines of credit. MCAs are based on a business’s cash flow, not its credit history or business history.

Get In Touch

702.883.9534

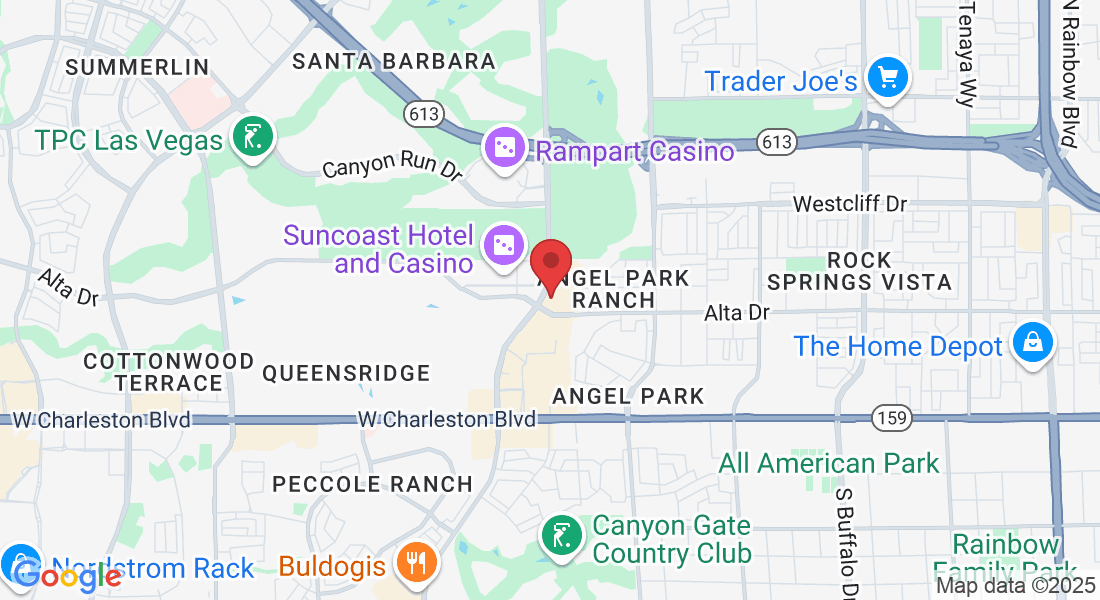

Address: 400 S Rampart Blvd, Las Vegas, NV 89145

Email: [email protected]

Hours of Operation:

Mon - Sat 8am to 8pm

Sunday – Closed

COMPANY

CUSTOMER CARE

PRODUCTS & SERVICES

LEGAL

© Copyright 2025. DEQ Capital. All Rights Reserved.

Strategic PartnershiGlober Footerps