Is Business Factoring Right For You?

Why Business Factoring Is Ideal for Small Business

Simple Approval Process

Unlike traditional loans, factoring has a fast and straightforward approval process. Approval depends on

customers' creditworthiness, not the business itself. With minimal paperwork, businesses often receive funding within days. This option suits those with limited credit histories or newer operations looking for quick financing.

Flexible Financing for Growth

Factoring provides flexibility by allowing businesses to factor in only the invoices they choose. As companies grow, so does their access to cash flow, ensuring scalability. This steady funding source helps seize new opportunities, whether expanding operations or launching new projects.

Common Scenarios Where Small Businesses Benefit from Factoring

Factoring isn’t just for covering cash flow gaps; it’s a versatile tool for various situations. From seasonal challenges to rapid growth, factoring fits multiple scenarios.

Seasonal Businesses with Variable Cash Flow

Seasonal businesses often face cash flow shortages during off-peak periods. Factoring bridges this gap by converting invoices into cash when sales slow. It enables businesses to cover expenses like rent, salaries, or inventory replenishment. Operations stay consistent, preventing disruptions and preparing the business for peak season demands.

Businesses Experiencing Growth

Expanding a business requires substantial funding for hiring staff, marketing, or upgrading equipment. Factoring helps secure immediate funds to cover these costs without incurring debt. It ensures that rapid growth doesn’t strain resources. For companies scaling quickly, it is a lifeline for stability during an otherwise volatile period.

Industries with Long Billing Cycles

Certain industries, such as construction, healthcare, and manufacturing, commonly face lengthy billing cycles. Factoring bridges the gap between providing services or goods and receiving payments. This solution is especially critical for maintaining vendor relationships and meeting payroll obligations without delays.

Businesses Seeking to Avoid Traditional Loans

Factoring offers an alternative to traditional loans, especially for small businesses with limited credit or collateral. It allows businesses to maintain liquidity without taking on debt, reduces reliance on lenders, and keeps ownership intact, making it an appealing choice for small businesses.

The Pros and Cons of Factoring for Small Businesses

Small businesses need reliable solutions for

cash flow management

and funding operations. Factoring provides immediate access to cash but comes with certain drawbacks to consider. Let’s evaluate its key benefits and potential challenges.

Pros

Factoring offers practical advantages that help businesses stabilize finances and support growth. Here’s how:

Quick access to working capital without incurring debt: Factoring provides immediate funds by selling unpaid invoices, enabling businesses to manage operations without waiting for customer payments. No loan repayment is required.

Improves cash flow predictability and financial stability: Regular access to funds allows businesses to manage expenses consistently. Predictable cash flow ensures that companies meet operational needs and avoid disruptions in critical activities.

No impact on ownership or equity: Factoring doesn’t require giving up any part of the business. Owners maintain full control and decision-making power through this non-debt financing option while improving liquidity.

Cons

While factoring has benefits, it’s essential to understand the potential downsides:

Can be more expensive than traditional loans (factoring fees apply):Factoring involves fees ranging from 1% to 5% of the invoice value, which may increase costs compared to low-interest loans.

Relies on customer creditworthiness, not the business’s credit: Approval and funding depend on the credit profile of your customers. Businesses with less reliable clients may face challenges with factoring.

May affect customer relationships due to third-party involvement: Factoring companies collect directly from customers, which can lead to misunderstandings or strained relationships if communication isn’t managed carefully.

How to Get Started with Business Factoring

Businesses can benefit from factoring by taking a few simple steps to align this solution with their financial goals. Let’s explore how to start using this tool effectively.

Evaluate Needs: Determine whether factoring fits your cash flow requirements and operational goals. Assess how factoring compares to other options like factoring vs. inventory financing, and choose what’s most effective for your situation.

Research Providers: Compare factoring companies' fees, contract terms, and reputations. Look for transparent pricing, good customer reviews, and reliable customer service to ensure a positive experience.

Prepare Documentation: Gather all relevant financial documents, including invoices, customer details, and information about outstanding payments. Organizing records speeds up the approval process and ensures accurate funding.

Understand Terms: Review the factoring contract carefully and determine whether the agreement is recourse or non-recourse. Clarifying these details prevents surprises during the process. This step is crucial in understanding and effectively utilizing invoice factoring for cash flow.

Begin Factoring: Submit invoices to the factoring company and receive your advance. Once the customer settles their invoice, the remaining balance, minus fees, will be paid.

Conclusion

Business factoring for small businesses offers a practical solution to improve cash flow, fund operations, and fuel growth. It provides immediate working capital without adding debt, making it an attractive alternative for many companies.

By addressing questions like how factoring helps a business and what are the advantages of factoring in business, small businesses can better understand its value. Explore factoring as a reliable financing option to simplify cash flow management.

Consult a factoring company or financial advisor to determine the best approach for your needs. For more insights, read Simplify Business Financing: No Credit Check Required.

WHY DEQ FINANCIAL?

STELLAR REPUTATION

Backed by thousands of 5-Star reviews, facing our business financing experts will work with you to solve your business challenges.

TECHNOLOGY-FIRST APPROACH

DEQ Intelligence uses AI to streamline the funding process. Get an instant pre-approval and flexible loan options that fit your business needs.

MULTIPLE OPTIONS

Choose an offer that makes the most sense for you and your business. Compare offer terms and choose what works best.

ZERO SUPRISES

DEQ's offer calculator takes the guesswork out of business financing. It provides full transparency on terms. No suprises.

DEQ FINANCIAL Intelligence- Our winning combination of quick delivery and excellent customer care. Getting started is easy.

STEP 1. APPLY ONLINE

STEP 2. REVIEW OPTIONS

STEP 3. RECEIVE YOUR FUNDS

500+

Satisfied Customers

15+

Years of Experiance

20+

Cities Covered

5k

Staff Members

Get In Touch

702.883.9534

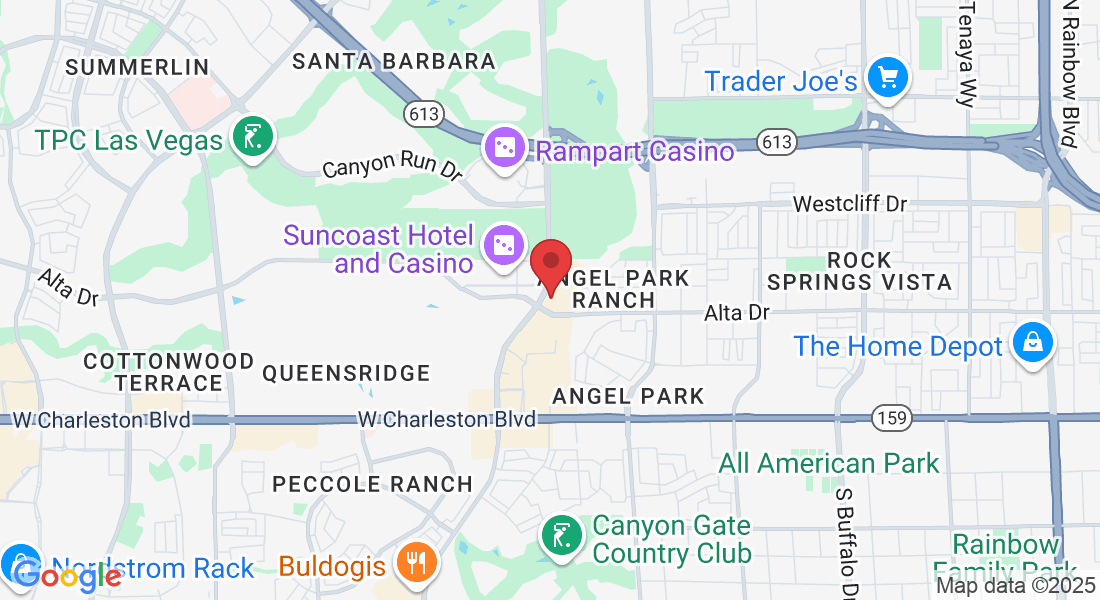

Address: 400 S Rampart Blvd, Las Vegas, NV 89145

Email: [email protected]

Hours of Operation:

Mon - Sat 8am to 8pm

Sunday – Closed

COMPANY

CUSTOMER CARE

PRODUCTS & SERVICES

LEGAL

© Copyright 2025. DEQ Capital. All Rights Reserved.

Strategic Partnerships